Bulk Transportation, Chemical Transportation

Liquid Bulk Transportation: Current Market Challenges

Numerous external factors continue to shrink transportation capacity, particularly for the specialized liquid bulk market and will compromise availability for the foreseeable future.

- Expansion of the North American Chemical Industry

- Recovery of the Oil and Gas Industry

- Introduction of New Government Regulations — ELD Mandate

- Hurricane Harvey & Hurricane Irma

- Driver Shortage

Key Drivers

1. EXPANSION OF THE NORTH AMERICAN CHEMICAL INDUSTRY

Chemical production in North America continues to grow. The American Chemistry Council (ACC) is estimating that chemical shipments will increase 34% in the five year period leading up to 2024, representing $1 trillion (USD).

Much of this predicted activity will be fueled by foreign chemical companies moving into the North American market. North America has become more attractive due to the extensive reserves of shale gas throughout the continent as well as access to strong financing options. Chemical Mergers & Acquisitions activity has seen many offshore chemical companies reducing local production while expanding into the United States.

2. RECOVERY OF THE OIL AND GAS INDUSTRY

The increased demand for fracking production is spurring on the recovery of the oil and gas industry. Fracking is shorthand for “hydraulic fracturing”, a type of drilling undertaken to access oil and natural gas reserves. Fracking requires bulk drivers to move sand and chemicals to the extraction sites and oil to rail heads. There is also an economic ripple effect: the fracking industry pumps business into the economy by creating demand for additional raw materials which leads to an increase in demand for chemical transportation via bulk truck.

While statistics vary on how the economy is being impacted by fracking, there is little doubt that it has significantly reduced the availability of bulk capacity.

3. INTRODUCTION OF NEW GOVERNMENT REGULATIONS – ELD MANDATE

Truck drivers have always monitored and reported their activity using paper logbooks. On December 18, 2017, a U.S. government mandated transition to ELDs (Electronic Logging Devices) will begin. Requiring the use of ELDs is being implemented in part to re-assert safety as the number one priority for the trucking industry. The Federal Motor Carrier Safety Administration (FMCSA) target date for full implementation is December 16, 2019. The Canadian adaptation of the Mandate will closely follow the U.S. version with only a few variances.

Since an ELD device integrates with the truck’s engine, it will record all activity while the truck is in motion and track the driver’s compliance with the Hours of Service (HOS) rules. In practice, this will mean that drivers will occasionally be forced to stop driving in order to take an enforced 10 hour break, or perform a weekly “reset.” In some cases, this will lead to them being unavailable to load or unload within the requested time windows.

This will have the biggest impact on shipments moving in laneways of 450-600 miles. By default, such trips require more than one calendar day in transit which renders them vulnerable to unscheduled and unpredictable delays. Heavy traffic, inclement weather, and mechanical issues are hard to plan for at the best of times. What is within the shipper or receiver’s control however, is the ability to ensure smooth and timely loading and unloading of freight at your facility. Delays of any sort inevitably negatively impact the driver’s HOS adherence.

4. HURRICANE HARVEY & HURRICANE IRMA

Recovery from extensive damage done by Hurricane Harvey in Texas, and to the Houston area in particular, is underway. Rebuilding of infrastructure, repairs to oil refineries and replenishing the shelves of storm-struck commercial retail will take time and divert truck capacity while driving up rates. Houston may be the largest chemical market in North American, but Florida, like Texas, is home to significant players in the chemical and petrochemical industries. Many significant metropolitan areas have sustained unprecedented storm damage in Irma’s wake. Expect cleanup and reconstruction efforts to bring additional pressure to bear on already stressed capacity options in the affected areas. Supply chain disruptions leads to supply chain adjustments.

5. DRIVER SHORTAGE

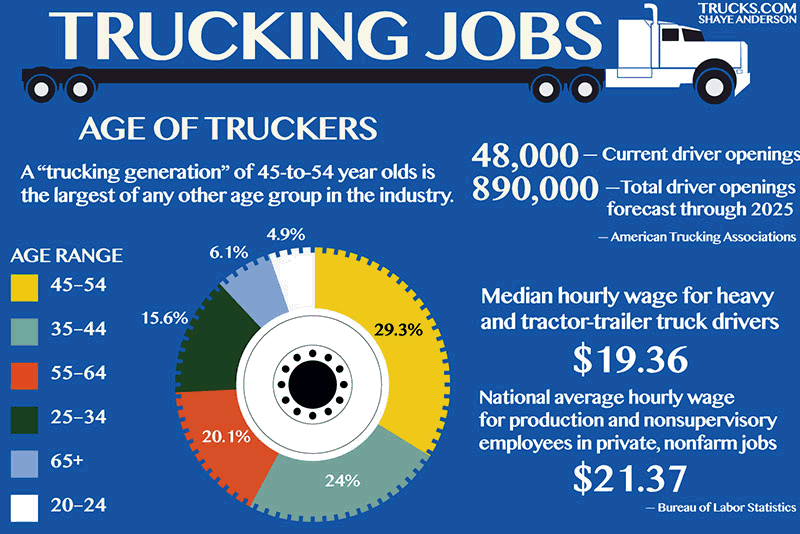

The average long-haul truck driver is male and over 50. Simply put, there are not enough young candidates — and even fewer women — applying for driving positions. This reluctance to engage seems to stem from a wide range of socio-economic considerations which makes reversing the trend very difficult.The American Trucking Association (ATA) reports that the industry is currently short approximately 50,000 drivers.

As drivers retire or otherwise leave the industry, the ATA is forecasting that the shortage will grow to 175,000 drivers by 2024 due to this factor alone.

Source: American Trucking Association: Truck Driver Shortage Analysis 2015

Compounding this challenge are the needs of a growing economy. The ATA is calculating that 33% of new hires will be needed simply to service new business. They are estimating that over the next decade a total of 890,000 new drivers will be needed to fill demand.

Take-Aways for Bulk Shippers

- Lack of lead time on an order has become an issue. Many tank trucks are now booked 2-3 weeks out, depending on the lane.

- Geography matters: In the U.S., Texas, Louisiana and Georgia are amongst the tightest markets for bulk transportation.

- The after-effects of Hurricane Harvey in Texas and Hurricane Irma in Florida and points north, will further stress capacity in these areas.

- It is becoming more challenging to source equipment for short-haul bulk lanes (under 400 miles) and long-haul bulk lanes (over 1400 miles).

- Expansion of the chemical market in North America is underway and shows no signs of slowing down.

- Consider shipping in Totes or Drums. While it may not be the optimum solution, it will get your product delivered on shorter lead time.

- In short, “Just-In-Time” bulk shipping is rapidly becoming a thing of the past. The “New Norm” is longer, substantial lead time.

10 Solutions to Strengthen Your Supply Chain

- Be Open-Minded! Keep an open-minded approach to understanding the challenges of the current chemical logistics marketplace as well as to what the future may bring.

- Educate! Use the information provided here to educate your clients, colleagues, and associates about the trends in the industry.

- Review! Take a look at internal protocols to ensure effective inventory management with the goal of increasing lead-time for shipments.

- Get Regular! If possible, establish frequency and consistency: schedule and book a truck in advance (1 per week, 1 per month, 1 bi-monthly, etc.) Also try to anticipate last-minute requests and rush shipments.

- Be Flexible! Adopt flexible pickup and delivery windows. Facilities which close mid-afternoon may find themselves at a particular disadvantage since requiring a truck to wait overnight to be loaded or unloaded negatively impacts Hours of Service adherence.

- No Changes! Limit making changes to your order once booked. Changing a pickup date after a truck is scheduled will risk losing that truck. More freight or more weight to load than was booked can also result in a lost truck if the driver cannot accommodate the change once on-site.

- Understand! Create an understanding within your organization that drivers have choices – demand for these drivers’ services far exceeds the supply. Drivers want to work with clients who treat them with respect and professionalism. Cooperation and communication is key.

- Be Clear! Always provide clear, accurate and detailed equipment requirements to transportation partners.

- Maximize! Maximize payloads when possible.

- Be Inviting! Help drivers effectively navigate your facility by clearly marking restricted zones, authorized parking areas, and where they need to check-in upon arrival. Providing amenities like washroom access and an air conditioned waiting area are small gestures that can go a long way in setting your facility apart when drivers and dispatchers make routing decisions.

Leave a reply

You must be logged in to post a comment.